The 9-Minute Rule for Stonewell Bookkeeping

How Stonewell Bookkeeping can Save You Time, Stress, and Money.

Table of ContentsSome Ideas on Stonewell Bookkeeping You Should KnowThe Single Strategy To Use For Stonewell BookkeepingThe Ultimate Guide To Stonewell BookkeepingStonewell Bookkeeping - The FactsThe smart Trick of Stonewell Bookkeeping That Nobody is Talking About

As opposed to undergoing a filing closet of different files, invoices, and invoices, you can offer thorough documents to your accountant. Subsequently, you and your accounting professional can save time. As an added bonus offer, you may even be able to identify potential tax write-offs. After using your bookkeeping to submit your taxes, the IRS might pick to perform an audit.

That financing can be available in the kind of owner's equity, grants, business financings, and investors. Yet, capitalists need to have an excellent concept of your service prior to spending. If you don't have audit documents, capitalists can not identify the success or failing of your business. They require current, precise info. And, that details needs to be easily obtainable.

Some Known Facts About Stonewell Bookkeeping.

This is not meant as legal suggestions; to find out more, please visit this site..

We responded to, "well, in order to recognize how much you need to be paying, we require to recognize exactly how much you're making. What are your incomes like? What is your web income? Are you in any type of financial obligation?" There was a lengthy time out. "Well, I have $179,000 in my account, so I presume my internet income (revenues much less expenses) is $18K".

Fascination About Stonewell Bookkeeping

While it can be that they have $18K in the account (and also that may not be true), your balance in the bank does not necessarily determine your profit. If someone obtained a give or a car loan, those funds are not taken into consideration earnings. And they would certainly not infiltrate your income statement in establishing your profits.

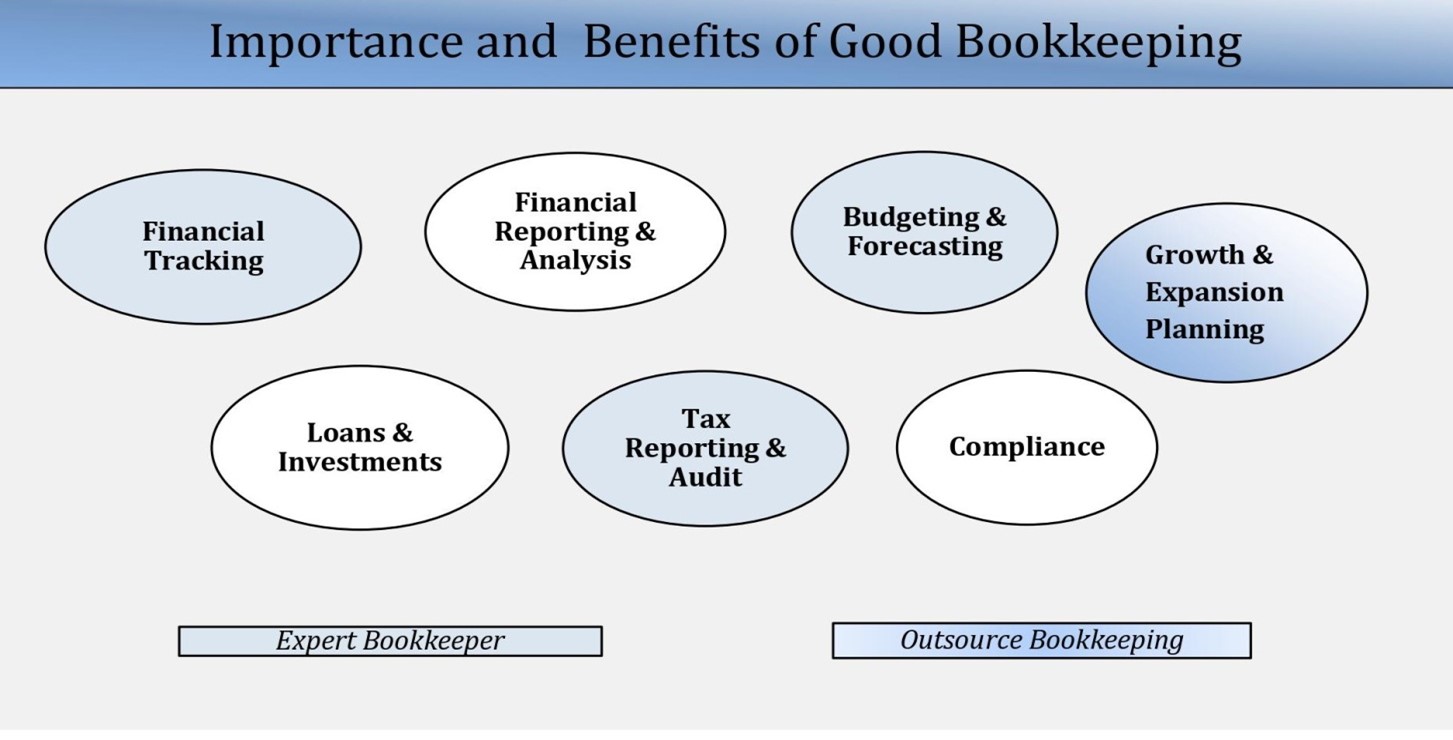

Numerous points that you think are expenditures and reductions are in fact neither. An appropriate set of publications, and an outsourced accountant that can effectively classify those transactions, will certainly assist you determine what your business is really making. Bookkeeping is the procedure of recording, identifying, and arranging a firm's economic deals and tax obligation filings.

An effective business needs aid from professionals. With sensible objectives and a skilled bookkeeper, you can conveniently address difficulties and keep those worries at bay. We're below to aid. Leichter Audit Providers is a skilled certified public accountant company with an enthusiasm for accountancy and commitment to our customers - franchise opportunities (https://anotepad.com/notes/qmk5gfhb). We devote our power to ensuring you have a strong monetary structure for development.

The Best Strategy To Use For Stonewell Bookkeeping

Precise accounting is the backbone of good monetary management in any service. With great accounting, companies can make much better choices because clear financial records supply useful information that can direct approach and increase earnings.

Precise economic declarations build trust with lending institutions and investors, raising your opportunities of obtaining the resources you need to expand., businesses should frequently integrate their accounts.

They guarantee on-time repayment of expenses and quick customer negotiation of invoices. This boosts capital and aids to stay clear of late fines. An accountant will certainly cross financial institution statements with interior click here for info documents a minimum of once a month to find errors or inconsistencies. Called financial institution settlement, this process guarantees that the financial documents of the firm suit those of the bank.

Money Flow Declarations Tracks cash money motion in and out of the company. These records assist company proprietors recognize their monetary position and make educated choices.

The Ultimate Guide To Stonewell Bookkeeping

The most effective selection depends upon your spending plan and organization requirements. Some local business owners like to manage accounting themselves making use of software. While this is affordable, it can be lengthy and susceptible to errors. Tools like copyright, Xero, and FreshBooks allow business proprietors to automate accounting jobs. These programs assist with invoicing, financial institution reconciliation, and economic coverage.